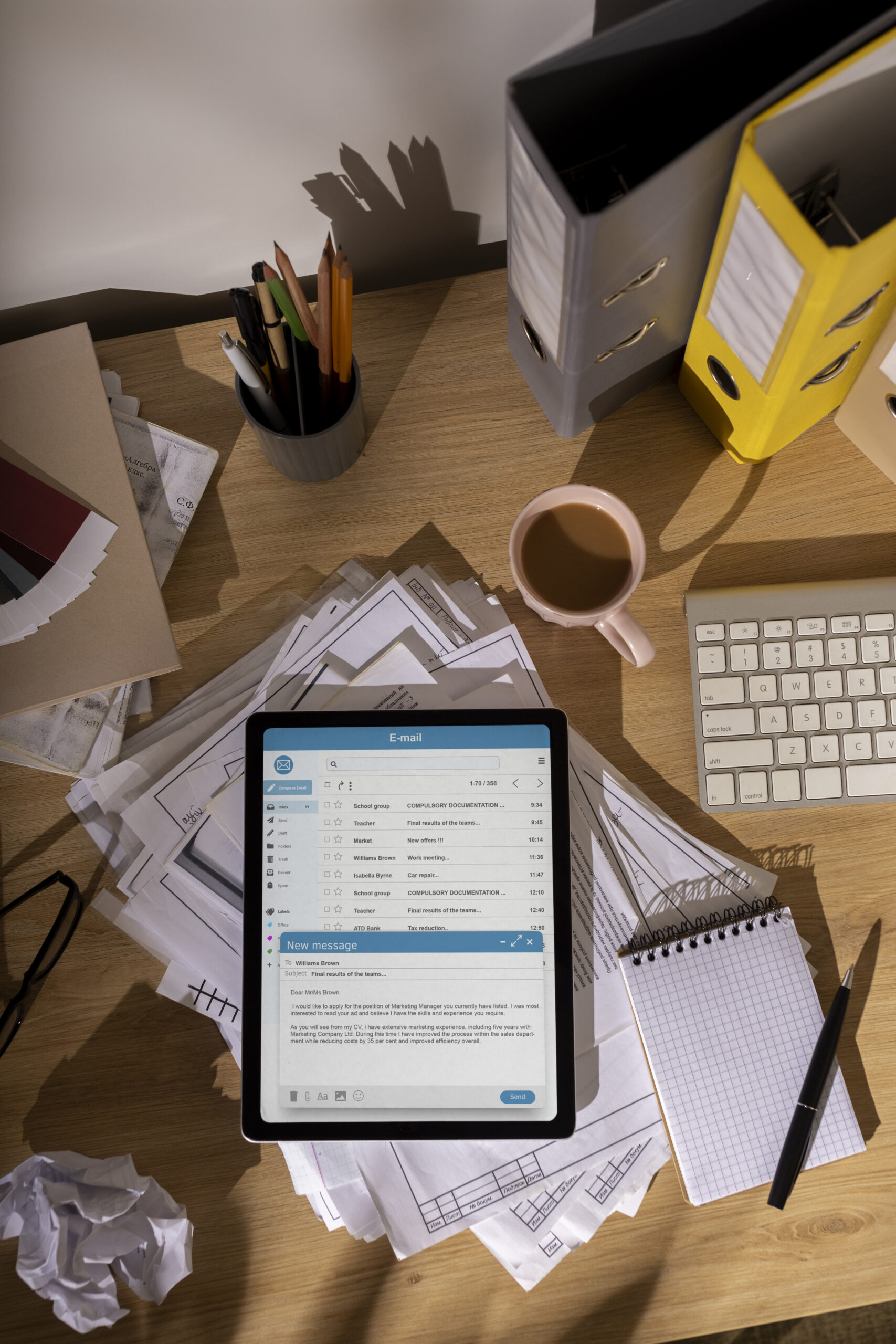

Turn your unpaid invoices into immediate working capital. At Hill Country Factors, we help businesses bridge the gap between delivering great work and getting paid. Instead of waiting 30, 60, or even 90 days for customer payments, you can access up to 95% of your receivables within days. Our Accounts Receivable Factoring program is built for companies that need consistent cash flow to cover payroll, purchase materials, and take on new projects without slowing down. Whether you’re a growing contractor, supplier, or service provider, our solutions give you the freedom to focus on growth—not collections.

Access your funds faster and keep projects moving without payment delays.

Choose the invoices you want to factor with clear, simple terms.

Accounts Receivable Factoring is ideal for subcontractors and contractors dealing with long payment cycles, suppliers and vendors needing to cover material costs, and service providers seeking reliable working capital. It’s designed to give growing businesses the cash flow they need to stay competitive and take on new opportunities with confidence.

Send us the invoices you’d like to factor.

We advance up to 95% of the invoice value within days.

Your customer pays us directly on their normal terms.

Once payment clears, you receive the remaining amount—minus our transparent fee.

Think of it as turning your invoices into immediate capital. Instead of waiting 30, 60, or 90 days to get paid, we purchase your receivables at a discount, giving you the working capital you need now. Your growth shouldn’t be limited by your payment terms.

We look at the whole picture – your business, your customers, and most importantly, your potential. While we review traditional metrics, we’re more interested in understanding where you’re headed and how we can help you get there.

Your funding grows with your business. Since funding is based on your receivables, the more you grow, the more capital you can access. Up to 95% advance rates available for qualified clients.

Basic business documentation, recent financial statements, and accounts receivable/payable reports. But before any paperwork, let’s have a conversation about your business and goals.

B2B companies with creditworthy commercial customers. We work across industries but specialize in construction, manufacturing, and service businesses looking to scale.